Trusted by 1.2K Customers

Get Started On Saving Thousands, for Free.

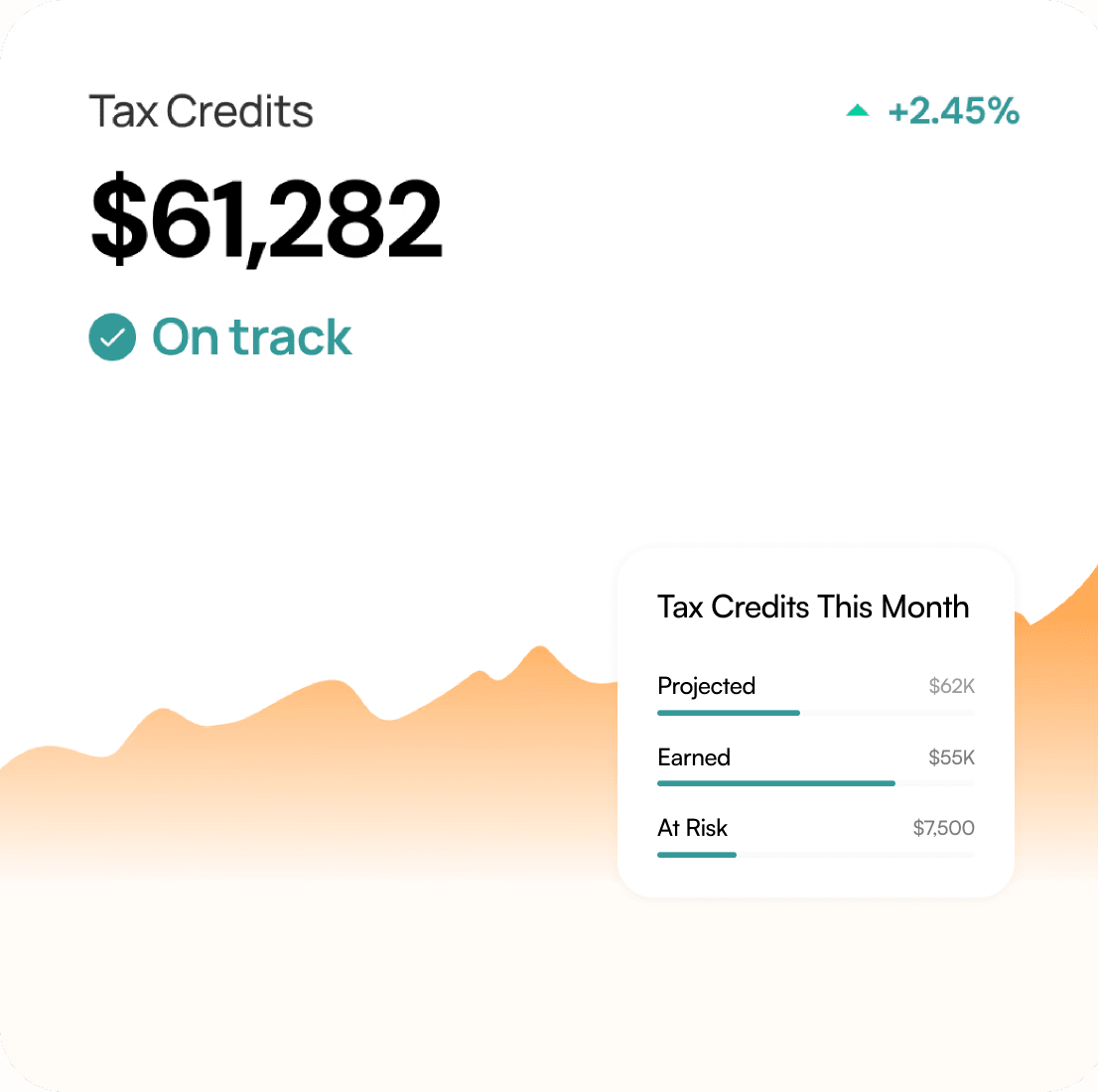

Full Hiring Tax Credit Services

WOTC tax credit maximization services

State, local, and federal tax incentive optimization

Flexible integrations and platform options

Dedicated tax pro support and consultations

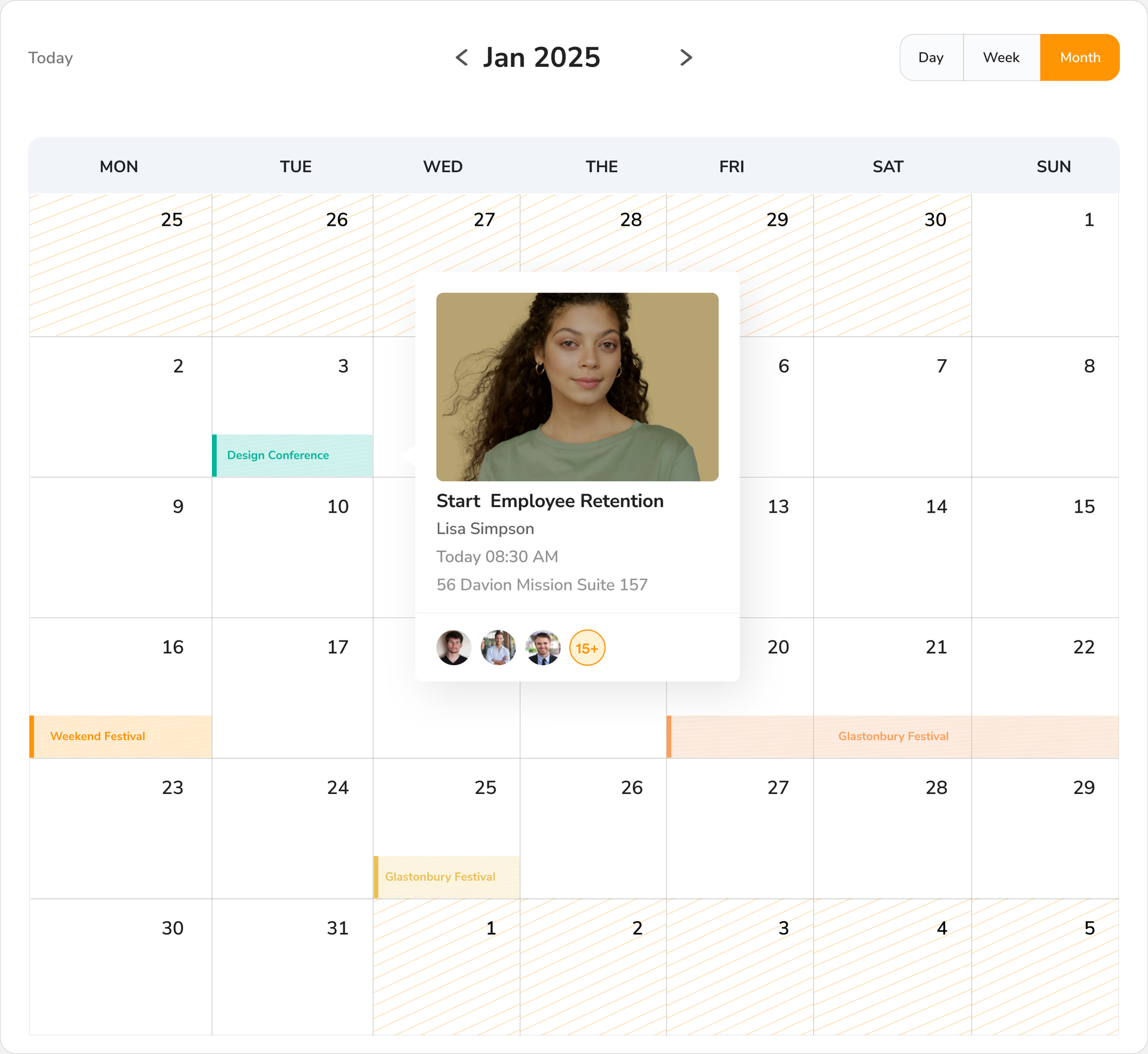

Employee Retention and Analytics

Identify employees who plan to quit

Understand why and how to engage them

Prevent attrition and reduce turn-over

Access tools to keep employees engaged

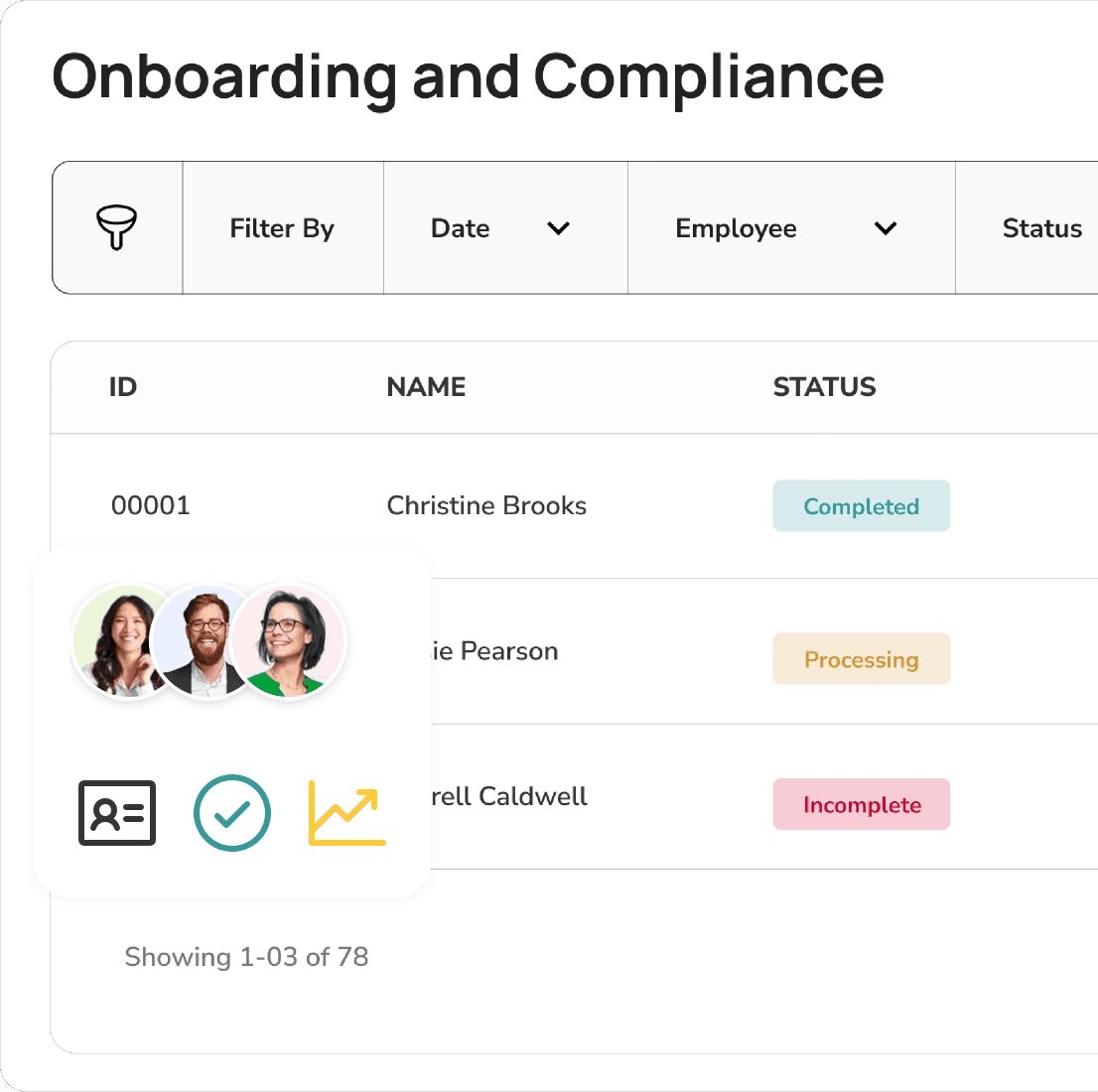

Seamless Onboarding and Compliance

Digital onboarding solutions for seamless hiring

Track onboarding progress with real-time updates

and reminders

Securely sign once—reuse your signature for

future documents

Upload and verify IDs securely with encrypted

document storage

I-9 and E-Verify

Reduce errors with guided I-9 completion and built-in

checks to ensure accuracy

Avoid fines by ensuring every section of the I-9 is completed

correctly and on schedule

Seamlessly integrate with E-Verify for instant

eligibility verification

Background screening included

Applicant Tracking System

Post jobs by role, location, or department with custom

questions

Applicants apply with documents, custom fields, and

e-signatures

Completely free to use

Boost Profitability

Reduce turnover costs while capturing valuable tax credits, turning employee retention into a financial advantage.

Gain Actionable insights

Leverage predictive analytics to identify attrition risks and optimize your workforce strategy.

Customize with Ease

Use predictive analytics to identify attrition risks and make informed workforce decisions.

Engage and Retain Talent

Gain deeper insights into attrition and leverage tools to boost engagement and role alignment.

Unlock Potential for Profitability

Maximize Financial Opportunities

Go beyond WOTC to claim additional federal, state, and local incentives for greater savings.

Client Success Stories

Canary delivers real results and measurable ROI. Our expert team and innovative solutions help companies across the U.S. maximize workforce value. See what we can do for you.

$0K

$0K

In Tax Credits

A nationwide manufacturing company received over $600,000 in tax credits for building a new plant in a state enterprise zone.

$0K+

$0K+

In Incentives

A 30 store convenience store chain averages over $100,000 per year in tax credits and incentives since signing-up with our program.

$0K

$0K

In Annual Incentives

A small supermarket chain has averaged $50,000 per year in Work Opportunity Credits (WOTC) alone after implementing our services.

0% More

0% More

In Annual Tax Credits

We helped a maintenance and cleaning service company qualify over 25% of their new hires to receive over $35,000 annually in tax credits.

Are You Ready To Start Making Better Hiring Investments?

Let's transform your workforce, improve onboarding, employee experiences, and uncover hidden financial opportunities for your business.